UDAAP and Disparate Impact Update

Some community banks believe that they are not subject to the unfair, deceptive or abusive acts or practices (collectively referred to as UDAAP) provisions of

Some community banks believe that they are not subject to the unfair, deceptive or abusive acts or practices (collectively referred to as UDAAP) provisions of

The Dodd-Frank financial reform legislation includes several points that have made it more difficult for community banks to operate profitably. These issues include higher capital

Dodd-Frank Wall Street Reform and the Consumer Protection Act have been among the key concerns for bankers in recent times. One of the more confusing

Depository institutions use loan participations as an integral part of their lending operations. Banks may sell participations to enhance their liquidity, interest rate risk management,

The uneven economic recovery may be sputtering along in fits and starts, but it appears loan volume has improved at commercial banks. According to Federal

written by Shawn Barbour The recent financial crisis and corporate scandals have generated more focus on corporate governance, which affects us all in different ways

Is it not amazing how powerful these smartphones we carry around are? They are tiny computers which allow us to do almost everything our computer

Many community banks rely on participation loans as a source of alternative funds for lending. Selling participation loans may enable banks to meet their borrowers’

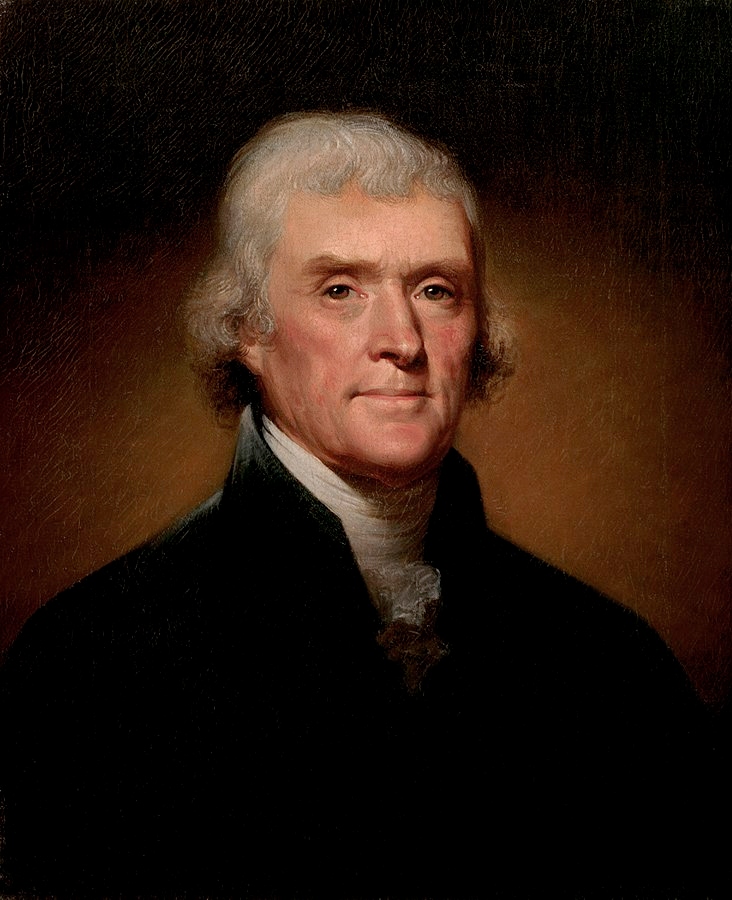

Nothing ever changes. Thomas Jefferson was criticizing big banks at the beginning of our history…

From the Daily Bail, a website devoted to bailout news, opinion and analysis:

Can We Party like it’s 1776 and Just Start Over? Thomas Jefferson’s Top 10 Quotes on Money and Banking

Amount billed for routine phone calls

Amount billed for services if not 100% satisfied

Sleepless nights knowing we’re in charge

Headaches figuring out tax regulations

Of your time devoted to making money

Stress free tax filing