How Will the 2016 ACH Changes Affect Your Bank?

written by Kami Bailey Is your bank informed about the ACH rule updates and changes for 2016? Each year NACHA comes out with improvements to

written by Kami Bailey Is your bank informed about the ACH rule updates and changes for 2016? Each year NACHA comes out with improvements to

Some community banks believe that they are not subject to the unfair, deceptive or abusive acts or practices (collectively referred to as UDAAP) provisions of

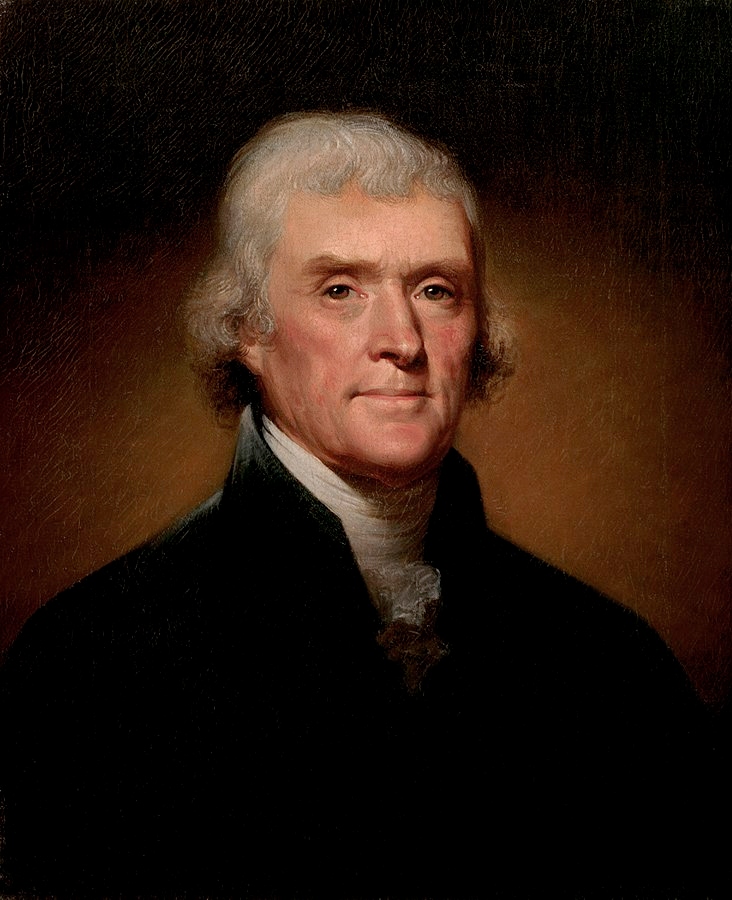

Nothing ever changes. Thomas Jefferson was criticizing big banks at the beginning of our history…

From the Daily Bail, a website devoted to bailout news, opinion and analysis:

Can We Party like it’s 1776 and Just Start Over? Thomas Jefferson’s Top 10 Quotes on Money and Banking

Amount billed for routine phone calls

Amount billed for services if not 100% satisfied

Sleepless nights knowing we’re in charge

Headaches figuring out tax regulations

Of your time devoted to making money

Stress free tax filing