A Step-by-Step Guide to Using Custom Financial Reporting for Your Business Success

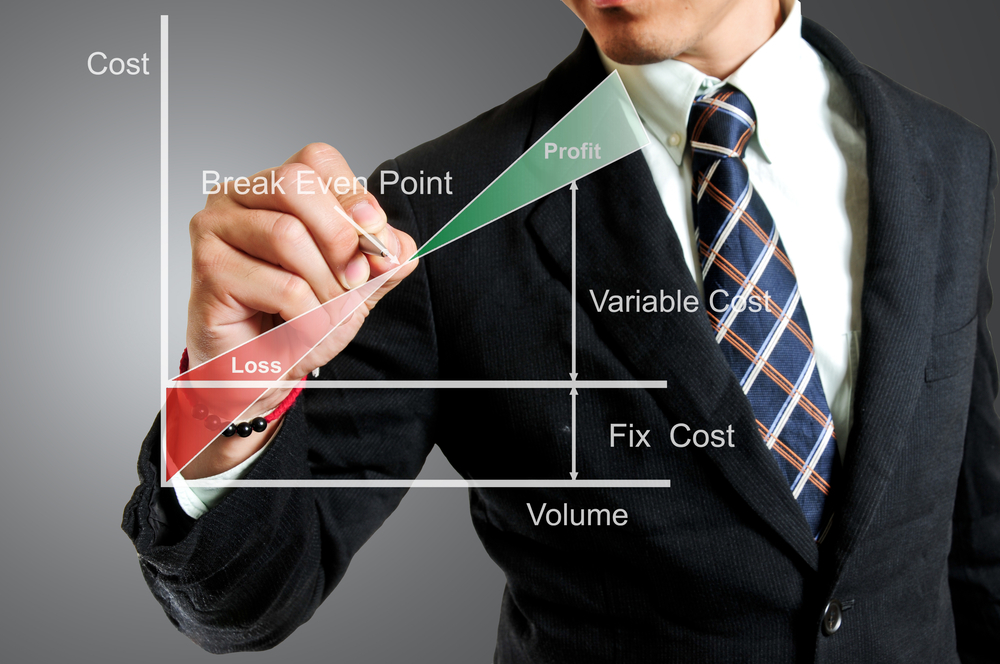

In today’s competitive business landscape, it is essential for companies to have a clear understanding of their financial performance. One of the most powerful tools

In today’s competitive business landscape, it is essential for companies to have a clear understanding of their financial performance. One of the most powerful tools

Creating a financial strategic plan is essential for the success and sustainability of your business. A financial strategic plan outlines the financial goals and objectives

Congratulations to CEO Josh Beaird on being named one of Springfield Business Journal’s 40 Under 40 honorees for the class of 2024. Over the past

As a business owner, one of your top priorities is undoubtedly growing your company. However, with growth comes increased income and a higher tax bill.

As a business owner, it’s only natural to wonder how your company stacks up against others on the same playing field. Are you ahead of

Cash flow is the lifeblood of any business, and without a healthy inflow and outflow of funds, it can be difficult for a company to

As a business owner, understanding your company’s financial health is crucial for making informed decisions and ensuring long-term success. One of the key financial statements

Your employee benefit plan (EBP) is a vital part of your company. Benefits keep your staff happy and well-compensated for the jobs they do. Your

The Whitlock Co. wants to warn business owners of a recent scam involving the Corporate Transparency Act (CTA). The Financial Crimes Enforcement Network (FinCEN) has

Amount billed for routine phone calls

Amount billed for services if not 100% satisfied

Sleepless nights knowing we’re in charge

Headaches figuring out tax regulations

Of your time devoted to making money

Stress free tax filing